Social Security’s 2026 COLA: What You Need to Know

The Social Security Administration (SSA) recently announced a 2.8% cost-of-living adjustment (COLA) for Social Security beneficiaries in 2026. While this percentage may seem modest compared to recent years, it marks a return to more historical norms. If you’re receiving Social Security benefits, this adjustment is critical, as it helps maintain the purchasing power of your benefits in the face of inflation.

Understanding how this annual adjustment is calculated, why it fluctuates, and what it means for your finances can give you better insight into how your Social Security benefits evolve. In this post, we'll explore the mechanics of COLA, its relationship to inflation, and what the 2026 adjustment means for beneficiaries.

What Is COLA?

The cost-of-living adjustment (COLA) is an annual increase in Social Security benefits designed to keep pace with inflation. In other words, it’s a way to ensure that your Social Security check doesn't lose value over time as the prices of everyday goods and services rise.

Each year, the SSA uses a specific inflation index, called the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), to determine the COLA. This index is a measure of the average change in prices over time for a basket of consumer goods and services. The CPI-W focuses specifically on spending patterns of urban workers, which include clerical workers, salespeople, laborers, and certain wage earners.

The SSA compares the average CPI-W during the third quarter (July, August, and September) of the current year to the same period in the previous year. If the CPI-W has risen, the COLA reflects that increase. If the CPI-W has remained flat or declined, no adjustment is made, as seen in years like 2010, 2011, and 2016 when no COLA was applied.

For 2026, the 2.8% COLA reflects inflationary changes during the third quarter of 2025.

Why Inflation Matters

Inflation is the primary driver of COLA adjustments. As inflation increases, the prices of essential goods like food, housing, transportation, and healthcare rise. To maintain the real value of Social Security benefits, COLA is intended to match these rising costs. However, inflation fluctuates year to year based on broader economic conditions.

In 2022 and 2023, inflation surged globally due to supply chain disruptions, labor shortages, and other pandemic-related factors. This led to substantial COLA increases—5.9% in 2022 and a notable 8.7% in 2023, marking the largest hike in over 40 years. However, as inflation began to moderate in 2024, the COLA for 2025 adjusted accordingly to 2.5%, signaling a return to more typical levels.

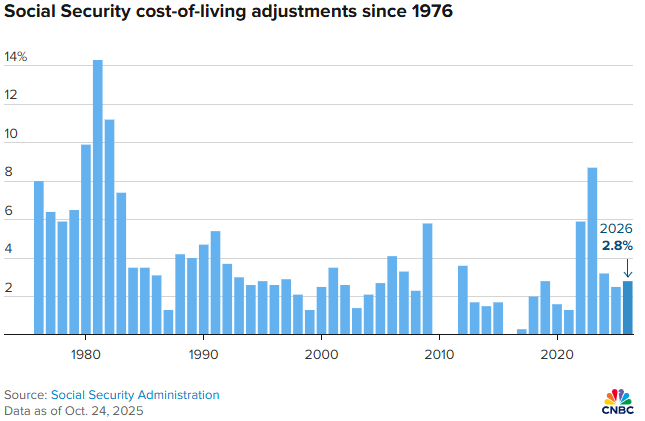

The chart below illustrates the historical COLA changes from 1976 to the present and provides context for how inflation impacts these adjustments:

Over the last 20 years, the Social Security COLA has averaged 2.6%, according to The Senior Citizens League (CNBC source). However, there have been spikes in times of higher inflation, as seen in the early 1980s and again in 2023. On the other hand, there were periods when inflation was so low that no COLA was applied, as noted in 2010, 2011, and 2016.

What Does the 2026 COLA Mean for Beneficiaries?

For many retirees and Social Security beneficiaries, a COLA increase is welcomed news. However, it’s essential to understand that the 2.8% increase announced for 2026 may not translate directly into a 2.8% boost in your monthly benefit. The reason lies in other variables that could affect your final benefit amount, such as changes to Medicare premiums or tax withholdings.

Here are a few key considerations:

- Medicare Premiums: If you’re enrolled in Medicare, part of your Social Security benefit may go toward your monthly Medicare Part B premium. In recent years, increases in Medicare premiums have offset some of the COLA gains. For example, in 2023, while Social Security benefits rose by 8.7%, many beneficiaries saw a smaller increase in their net benefit due to rising Medicare costs. The actual effect for 2026 will depend on what happens with Medicare premiums in the coming months.

- Taxes: If your total income (including Social Security) crosses certain thresholds, a portion of your Social Security benefits may be taxable. A higher COLA could push some recipients into higher income brackets, potentially subjecting more of their benefits to taxation.

- Inflation and Purchasing Power: While COLA is designed to offset inflation, the actual rise in living costs may vary depending on where you live and what you spend your money on. Health care and housing costs, for instance, tend to rise faster than other goods and services. Even with a COLA increase, you may find that your benefits still don’t stretch as far as they used to, especially if your expenses rise faster than the CPI-W.

Planning for 2026 and Beyond

Given the 2026 COLA increase, it’s a good time to reassess your financial plans for the upcoming year. Here are a few steps to consider:

- Review Your Budget: With the 2.8% COLA in mind, review your current expenses and determine if the increase will cover any rising costs. Pay particular attention to healthcare expenses, housing, and other essentials that may continue to outpace inflation.

- Medicare Considerations: If you’re on Medicare, keep an eye on announcements about Medicare Part B premiums and other healthcare costs for 2026. You’ll want to understand how these premiums might affect your net Social Security benefit.

- Tax Planning: If your total income is close to the thresholds that make Social Security taxable, consider consulting with a tax advisor. You may be able to adjust your income to reduce the amount of your benefits that are subject to taxes.

- Savings and Investment Strategy: Finally, for those supplementing Social Security with other savings or investments, now is a good time to review your overall strategy. Are your investments keeping pace with inflation? Do you need to adjust your portfolio to better protect your retirement income?

Conclusion

The 2026 COLA adjustment is a return to more typical levels, reflecting a slowdown in inflation after the significant spikes seen in 2022 and 2023. While the 2.8% increase is smaller than recent years, it still represents a crucial boost to help beneficiaries maintain their purchasing power.

As a Social Security beneficiary, it’s essential to stay informed about how changes to COLA, Medicare premiums, and taxes may affect your net benefit. Additionally, by proactively planning your budget, managing your healthcare costs, and reviewing your investment strategy, you can make the most of this increase and maintain your financial security in retirement.

Keep an eye out for the SSA’s official notice of your new benefit amount in December. You can also sign in to your online Social Security account to view this information when it becomes available. If you have any questions or need assistance in understanding how the COLA impacts your personal situation, feel free to reach out.

Eric Kirste, CFP®, CIMA®, AIF® is the founding Principal Wealth Manager at Savvy Wealth. With a deep-rooted passion for service and enriching the lives of others, Eric found his calling as a wealth management professional early on. Eric brings over 24 years of deep experience working closely with business owners, individuals and families in transition, helping them navigate difficult changes. Compassion is important to Eric, and he helps clients who are going through a divorce or grieving the loss of a spouse or family member get through the transition to financial independence and overcome new challenges with confidence. He also helps business owners and professionals nearing retirement ensure they are best prepared for their ideal retirement lifestyle. With a passion for helping others, Eric has volunteered for the Foundation for Financial Planning, AARP and is the Treasurer on the Board of Wings For Widows . Eric is a native of the northwest suburbs of Chicago. He is committed to giving back to his community and serves as the Treasurer for the Prospect Heights Park District Board of Commissioners and the Old Orchard Country Club. He enjoys spending time with his wife, Alisa, their two sons, Logan and Matthew, and their rescue dog, Bear.

Material prepared herein has been created for informational purposes only and should not be considered investment advice or a recommendation. Information was obtained from sources believed to be reliable but was not verified for accuracy. It is important to note that federal tax laws under the Internal Revenue Code (IRC) of the United States are subject to change, therefore it is the responsibility of taxpayers to verify their taxation obligations. You should consult with your financial advisor(s) and tax professional(s) to obtain specific information regarding costs, fees and other factors to consider to make informed decisions about your retirement. All investments involve risk, including loss of principal.