The Shutdown Continues; Employment & Housing Weaken; The Fed is Likely to Lower Rates

As the week ended, the equity markets sold off over trade issues with China. That country imposed a new “rare earths” export control policy where foreign entities must now obtain a license to export products that contain even a modicum of such rare earths. China mines 70% of the world’s supply and rare earths are critical for high tech industries including defense, automobiles, and the chip industry itself. As of this writing, President Trump responded, saying he would impose a 100% tariff on Chinese imports and impose export controls on critical software. Trump and Chinese President Xi were scheduled to meet face to face at month’s end. We’ll see if that meeting gets cancelled over the rare earths export controls, or, if the meeting takes place, if the rare earths issue is resolved. Stay tuned.

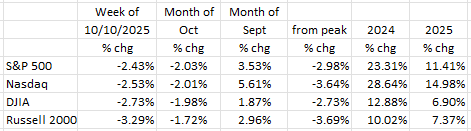

The table shows the weekly declines in the major indexes and the percentage changes from those index peaks. For three of the four major indexes, record peaks occurred this past week (ending October 10th)(The fourth index, the DJIA recorded an historic high on Friday October 3rd). As shown, equity markets were down in the -2.5% to -3.25% range for the week ending October 10th, and now negative for October month-to-date. Still, for the year as a whole, equity markets are substantially higher.

Besides the “rare earths” issue, the federal government shutdown continued unabated (day 10 as of Friday, October 10th) with Trump’s Office of Management and Budget announcing significant layoffs1 (i.e., Reductions In Force (RIF)) of federal employees.1 The difference in this shutdown vs. those of the past is that, while it is normal for federal workers to be laid-off during shutdowns, this time there is a significant number where the lay-offs are permanent. A key date in this shutdown is October 15th. That’s the payment date for those in the military. If the impasse over funding isn’t resolved by then, someone will be blamed. Will either political party take that risk?

Impact on the Fed

The next critical economic event occurs at the end of the month; it is the Fed’s next meeting (October 28-29). Given the intransigence in the Congress to pass a government funding bill, and data on inflation (CPI and PPI) and employment (Nonfarm Payrolls) remain unreported, it is our view that the Fed will still reduce rates by at least 25 basis points because, as economist David Rosenberg recently penned, “Every single measure of demand for labor is in the sick bay” (Rosenberg Research, “Breakfast with Dave”, October 9, 2025).

Employment

The U3 and U6 unemployment rates, at 4.3% and 8.1% respectively are the highest in four years (since October ’21).2 Private sector data show that the jobs market has softened. For example, per Economist Rosenberg, the hiring rate is tied for the lowest level in more than five years as is the “quits” rate (people don’t quit when jobs are scarce). And unemployment has risen significantly for African Americans and the young cohort (ages 16-24 years old). Challenger Gray and Christmas report that hiring plans are the lowest since ’09!3 Indeed reports that job postings are the lowest since February ’21. Intuit says small business employment fell -48.4K in September (negative in three of the last four months).4 The ISM Manufacturing Employment sub-index showed up in contraction territory (below 50) at 47.2 in September after a 46.5 reading in August.5 There is no doubt that the job market is softening.

Housing

The housing market is a key market regarding the economy’s health. It has also shown recent weakness. Let’s not forget that rising home prices produce a “wealth effect” where homeowners feel “wealthier” and, therefore, spend more. The fact of the matter is that home refinance and new mortgage applications are now on downtrends with mortgage applications down more than -17% in the two weeks ended October 3rd (Rosenberg, October 9th). This includes mortgage refinance (-7.7%) which generates excess cash and is an engine of increased consumption.

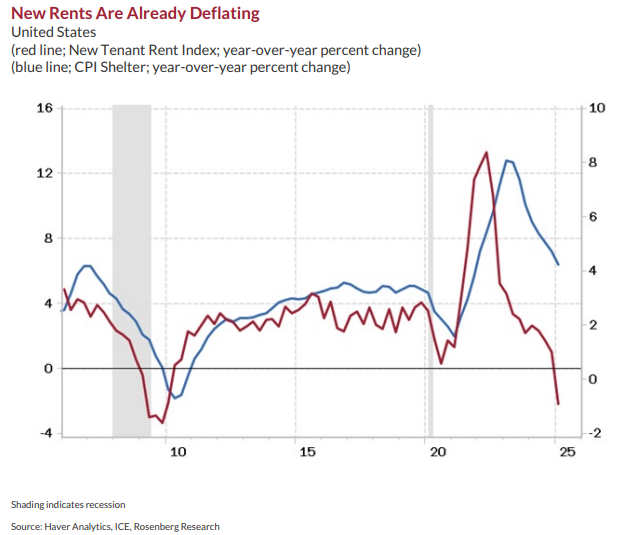

Shelter costs have a 35.5% and 44.4% weighting in the CPI and Core CPI indexes respectively. New rents are down -2.2%. The CPI Shelter Index has declined each month this year, and, at +3.3%, is the slowest since April ’21. In addition, the rental vacancy rate is the highest since 2017. The right hand side of the chart shows the close, but lagged, relationship between the New Tenant Rent Index (red line) and the CPI shelter index (blue line). Thus, we expect that rents will continue on their downtrend.

As a result, we see the inflation rate falling to the Fed’s target by year’s end or in next year’s first quarter. We also see rising unemployment, and we think the Fed will shift its focus to its full-employment mandate. This means falling interest rates for the foreseeable future. And despite the government shutdown, the Fed has enough evidence from private sector sources to reduce interest rates by at least 25 basis points at its October 28-29 conclave.

Other

In other signs of economic atrophy, the Chicago Fed calculated that Retail Sales grew 0% in September (vs. August), and that auto sales declined -0.5% despite the rush to purchase EVs prior to the September 30th tax credit expiration.

Final Thoughts

After hitting more record highs in early October, the equity markets look to be pausing in light of a weakening labor market and new trade tensions with China. Over the last week, markets have seen a mild sell-off. The question is: Is this the start of a long overdue market correction, or just another mild stumbling in this market juggernaut.

While economic data like the CPI and PPI and other critical information collected by the BLS won’t be available if the shutdown continues to the end of the month, there is enough private sector data that says the economy is slowing. This is especially true for employment and housing. Even before the shutdown, the official unemployment rates (U3 and U6) had risen to their highest level in four years. Nearly every private sector employment indicator showed up weaker in September. And the consumer appears to have responded by tightening their purse strings. It is likely that the Fed will lower rates by 25 basis points at its end of October meeting.

Dr. Robert Barone, Ph.D. is an economist whose storied career spans numerous decades and positions within the world of finance. Since gaining his Ph.D. in Economics from Georgetown, he has been a Professor of Finance (University of Nevada), a community bank CEO (Comstock Bancorp), and a Director of the Federal Home Loan Bank of San Francisco, where he served as its Chair in 2004. He lives and breathes the world of finance, continuing to provide clients and avid Forbes readers with his latest market insights.

(Joshua Barone and Eugene Hoover contributed to this blog.)

Robert Barone, Joshua Barone and Eugene Hoover are investment adviser representatives with Savvy Advisors, Inc. (“Savvy Advisors”). Savvy Advisors is an SEC registered investment advisor. Material prepared herein has been created for informational purposes only and should not be considered investment advice or a recommendation. Information was obtained from sources believed to be reliable but was not verified for accuracy.

Ancora West Advisors, LLC dba Universal Value Advisors (“UVA”) is an investment advisor firm registered with the Securities and Exchange Commission. Savvy Advisors, Inc. (“Savvy Advisors”) is also an investment advisor firm registered with the SEC. UVA and Savvy are not affiliated or related.

References:

1 https://www.npr.org/2025/10/10/nx-s1-5570933/shutdown-federal-workers-rifs-layoffs-vought

2 https://tradingeconomics.com/united-states/unemployment-rate/news/483231

.webp)